Online Account Opening (OLAO)

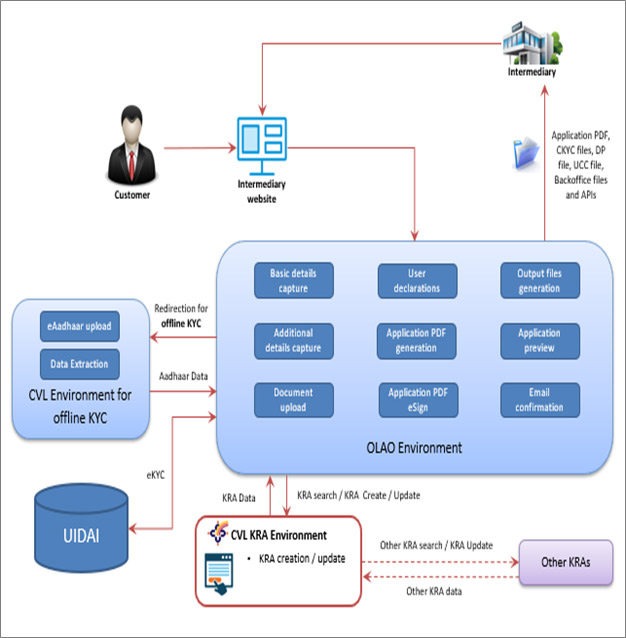

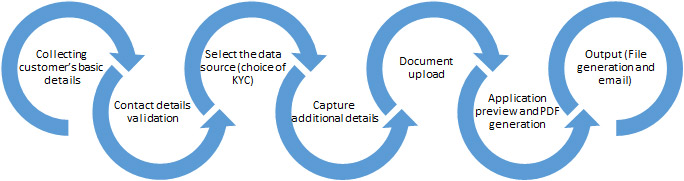

CVL has introduced an Online Account Opening (OLAO) application, which is a white labeled solution given to intermediaries as a SaaS (Software as a Service) model. The intermediary’s logo and color scheme can be applied on the application. This application is a complete solution for making KRA entry, generating CKYC files (through CVL KRA), generating DP, BO Upload file, and generating UCC files of customers and sharing the same with the intermediary. Also, it collects customer’s basic information and fetches further information from KRA via offline KYC method or eKYC (Online Aadhaar Data fetch). There is an additional provision to collect customer’s details which are not part of KRA and UIDAI. OLAO facilitates the customers of intermediaries to open various accounts (viz. DP, Broker etc.) in an online mode. It accepts customers basic information through an online portal via an intermediary. This customer information is validated based on PAN and/or Aadhaar, and customer’s information is extracted from respective agencies i.e. KRA or UIDAI. The application does online video recording of the customer and takes the photo of the customer. There is also an option in the application to upload various documents like PAN, specimen signature, cancelled cheque etc. The application also facilitates the customers to eSign the application PDF and other uploaded documents.

In addition, there is an admin module provided to intermediaries to take a stock of online applications received and to download the various files for processing. The application in the form of PDF file is also available to download. This is a complete solution to perform KRA creation/updation using eKYC and offline KYC methods. Application facilitates KYC search across KRAs for updating details in the application.

Benefits to Intermediaries

- Facilities opening of DP account and broking account in online mode which obviates the need for physical application and KYC documents.

- Enables upload of KYC details in CVL KRA and CKYC details in CERSAI, BO upload file and UCC file for BSE, NSE, MCX, etc.

- Enables subscription of specific modules as required by Intermediary.

- The application is in line with the SEBI guidelines for online account opening.