GST Suvidha Provider

CDSL Ventures Limited (CVL) has been appointed as a GST Suvidha Provider (GSP) by Goods and Services Tax Network (GSTN).

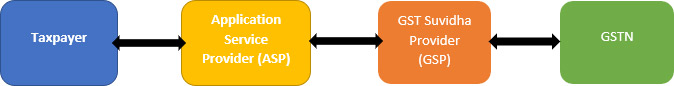

GST Architecture

As a GSP, CVL has partnered with GSTN to fulfil a very important and strategic role in the implementation of GST Tax Reforms. CVL would play a pivotal role in servicing a wide spectrum of tax payers by providing value added services thereby catering to sector specific/industry specific needs and making tax filing easy and convenient. CVL GSP would be authenticated with unique license keys and would in turn provide controlled access to APIs to its partners through sub license keys.

CVL, as a GSP, acts as a secure gateway for its registered partners, enabling seamless integration with the GSTN ecosystem. All data exchanged between CVL and GSTN is encrypted end-to-end, ensuring confidentiality and integrity of taxpayer information. CVL does not retain or access the content of the data transmitted; however, it maintains detailed transaction logs for a period of seven years, in compliance with regulatory and audit requirements.

Through its robust infrastructure and compliance-driven approach, CVL empowers its partners to deliver efficient, scalable, and secure GST solutions. This not only enhances the overall user experience but also contributes to the broader goal of digital transformation in India’s tax administration.

CVL’s tax filing solution ‘MySARAL GST’ provides a simple convenient and cost effective facility to tax payers and tax consultants for filing GST Returns. The front end access to taxpayers is through the ASP Application. The ASP data is pushed to GSTN via the GSPs.

Product Features

- Seamless and automated transfer of data on a real time basis.

- No changes required to be done in Customer’s ERP or any other system, unless mandated by regulations.

- Customer has option to upload data manually to ensure operations are not impacted under any circumstances.

- Validation and controls to mitigate operational and compliance risk.

- Creation of multiple users on need-to-do and need-to-know basis along with various Reports and MIS for management and staff.

- Every entry uploaded in the system will carry a flag showing status of the entry & its stage of processing for complete transparency to customer.

-

CVL GSP provides E-Way bill API’s to enable tax payers or transporters use our API interface to integrate with their system and generate E-way bills.

API would provide the below functionalities:- Seamless and automated generation of E-Way Bill and Consolidated E-Way Bills.

- Auto calculation of Geographical Distance on-the-fly.

- Assignment of vehicles to invoices (one to many and many to many) to simplify the operations.

- Tracking of undelivered, expired, unused E-Way bills to ensure prompt action.

- Allows restricted access to third parties like transporters, clearing agents etc.

- Automated and manual data upload of data with easy mapping features.

- Creation of customer, vendor, warehouse, product and transporter masters.

- Creation of multiple users on need-to-do and need-to-know basis along with various reports and MIS for management and staff.

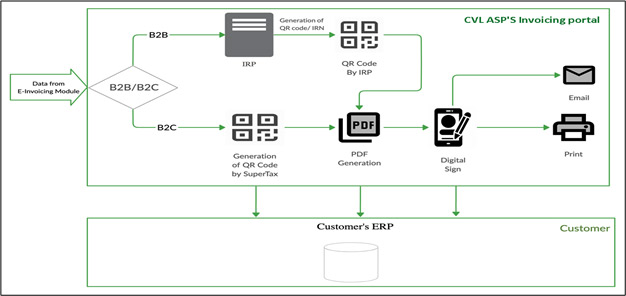

The GST Council has approved the introduction of e-invoices in a phased manner for reporting business to business (B2B) invoices to the GST system. E-invoice has been implemented for businesses with turnover more than 5 crore as per the latest amendment in August 2023.

The notified taxpayers have to generate the IRN for the supplies/sales. The IRN has to be generated for Invoices, Debit Notes, Credit Notes for B2B and export transactions. The taxpayer has to upload the complete invoice details, prepared manually or through the ERP/accounting system and after due validations of the data, the IRP returns the IRN with the signed invoice and QR code back to the taxpayer. The QR code has to be printed by the taxpayer on the invoice being issued to buyer. The IRN can be generated by the supplier only and not by the transporter/buyer.

CVL also provides e-invoice APIs to third party ASPs.

- These APIs provide seamless integration of ERP systems such as SAP, Oracle, etc. of the taxpayers with the e-Invoice system.

- The taxpayer can record the Invoice Reference Number and Acknowledgement number on their system online.

- These APIs will help in eliminating the duplicate or double-entry of the invoice as the GST system will automatically fetch the data from the IRP.

- Automation using APIs will eliminate the errors that can occur during data entry for e-Invoice.

- One time entry of e-Invoice will act as an input for the generation of E-Way Bill and the ANX-1 easily later.

CVL E-invoice solution is available for taxpayers having turnover of 5 crores or more,where user can carry out following activities.

- Create einvoice template by creating a one-time mapping of the ERP output. Template. can enable upload of eway bill data as well.

- User can upload Invoice, download the response file.

- Unique IRN number is generated for invoice successfully uploaded.

- IRP System will generate QR code containing IRN (hash) along with important parameters of invoice and digitally sign it so that it can verified online or offline.

- User can take the response file back to his ERP system where the invoice can be printed with the QR Code, Company’s logo and digitally signed before issuing to the buyer.

- The User can also download the detailed E-invoice PDF file. The format of the invoice can be custom designed as per requirement.

- CVL provides GST filing solution to Taxpayers to enable them file GST returns.

- CVL also provides services to notified taxpayers to generate e-invoices..

- CVL as a GSP onboards Application Service Providers (ASPs) and provides GST APIs, eway bill APIs and e-invoice APIs based on requirement.

- For further details on onboarding, send us your query to [email protected].

List of Clients

| Sl. No. | List of Tax-payers | List of ASPs |

|---|---|---|

| 1. | New India Assurance Company Limited | Proto Technology Solution Pvt Ltd |

| 2. | Oriental Insurance Company Limited | Prompt ERP Ltd |

| 3. | Spun Micro Processing Pvt Ltd | Incresol Software Services Pvt Ltd |

| 4. | Central Depository Services (India) Ltd | Skyway Computers Pvt Ltd |

| 5. | Kerala Agro Machinery Corporation Limited | Perfios Software Solution Pvt Ltd |