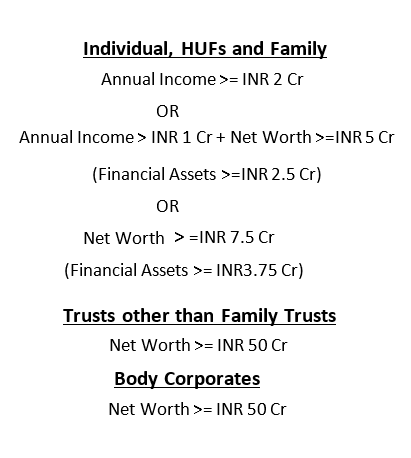

SEBI has introduced a new class of investors called ‘Accredited Investor’ to differentiate them from regular investors. One of the reasons why this class was introduced is to protect those investors who may not be familiar with the investments they are investing in and, therefore, subject themselves to high risks of losing money.

By setting such strict requirements, SEBI would be able to reasonably ensure that investors who earn the coveted ‘Accredited Investor’ title are those who are knowledgeable about high-risk investments and financially stable enough to absorb any potential losses resulting from unregulated securities.

Instead of limiting the trading of risky securities, regulators set limitations to allow only the most qualified and financially stable investors to invest in unregistered securities. Such investors can make huge returns if the investments are successful or withstand the losses if the securities fail to yield the expected returns.

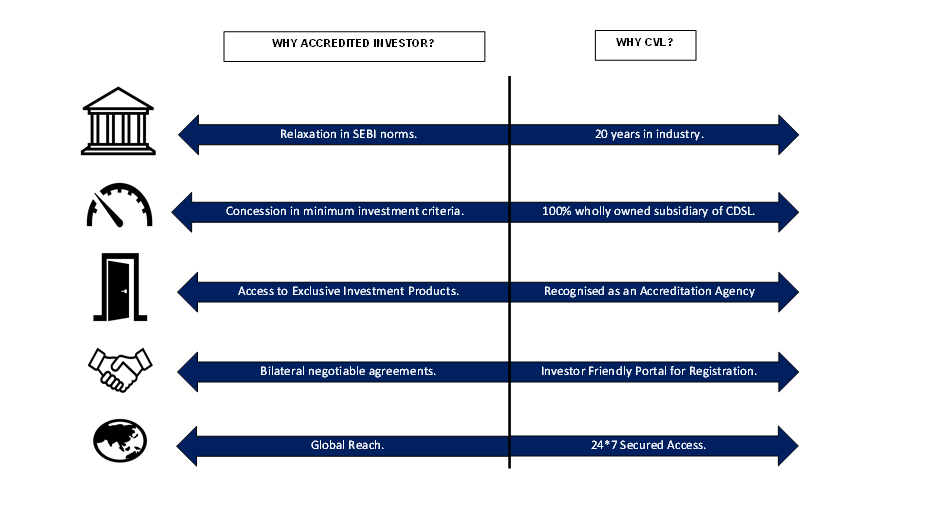

CVL Accreditation Agency

A subsidiary of a recognised stock exchange or a subsidiary of a depository, or any other entity as may be specified by the Securities & Exchange Board of India (SEBI) from time to time can apply to SEBI for recognition as an Accredited Agency.

CDSL Ventures Limited (CVL), a 100% wholly owned subsidiary of Central Depository Services (India) Limited [CDSL], has been recognised as an Accreditation Agency by Securities and Exchange Board of India (SEBI) to enable accreditation of Domestic and Foreign Investors as per the norms prescribed by SEBI. Persons desirous of being reckoned as Accredited Investors (AIs) shall approach an Accreditation Agency for accreditation.

ACCREDITED INVESTOR (AI)

An Accredited Investor (“AI”) is an investor who meets the requirements set out by the Securities and Exchange Board of India (SEBI) vide Circular number SEBI/HO/IMD/IMD- I/DF9/P/CIR/2021/620 dated August 26, 2021 and SEBI/HO/AFD/PoD1/CIR/2023/ 189 dated December 18,2023 and has obtained a certificate as an ‘Accredited Investor’ from an Accredited Agency (CVL) recognised by Securities and Exchange Board of India. Investors can visit https://aia.cvlindia.com and submit the application for accreditation.

INVESTMENT PROVIDER (IP)

An investment provider (AIFs/PMS/RIAs-registered with SEBI) offers customers the opportunity to invest in specific investment products or invest in certain strategic funds, and it is upto the Accredited Investor to choose to invest in those products or funds.

Steps of getting an ACCREDITED INVESTOR certificate on CVL

ACCREDITED INVESTOR would have to follow 4 easy steps to get the Accredited Investor Certificate.The Certificate would be issued within 3 business days if the documentation is complete and found to be in order.

1. For Investor Certificate Issuance:

| Sl. No. | Investor Type | Processing Fees (Rs) | 2 Years - Duration Certificate Fee (Rs) | 3 Years – Duration Certificate Fee (Rs) |

|---|---|---|---|---|

| 1. | Individual Investors, HUFs, Family Trusts, and Sole Proprietorship | Rs. 5,000/- | Rs. 5,000/- | Rs. 9,500/- |

| 2. | Partnership Firms | Rs. 5,000/- | Rs. 10,000/- | Rs. 19,000/- |

| 3. | Trusts (other than family trusts) | Rs. 5,000/- | Rs. 15,000/- | Rs. 28,500/- |

| 4. | Body Corporates/LLP | Rs. 5,000/- | Rs. 15,000/- | Rs. 28,500/- |

2. For Investment Provider registration and verification of AI Certificates:

| Sl. No. | Entity Type | One Time Registration Fees (Rs) | Annual Charges (Rs) | Verification Fee (Rs) |

|---|---|---|---|---|

| 1. | Alternative Investment Fund | Rs. 5,000/- | Rs. 2,000/- | Rs. 500/- per Certificate |

| 2. | Portfolio Manager Services | Rs. 5,000/- | Rs. 2,000/- | Rs. 500/- per Certificate |

| 3. | Investment Adviser | Rs. 5,000/- | Rs. 2,000/- | Rs. 500/- per Certificate |

For more details visit https://aia.cvlindia.com